Introduction

The scope of the Panel’s jurisdiction is set out in section 3 of the Introduction to the Code. The Panel regulates takeover bids and merger transactions (however effected) of certain companies which have their registered offices in the UK, the Channel Islands or the Isle of Man, i.e. companies which are “UK registered”. The Panel does not regulate takeover bids and merger transactions of companies that are registered in any jurisdiction other than the UK, the Channel Islands or the Isle of Man.

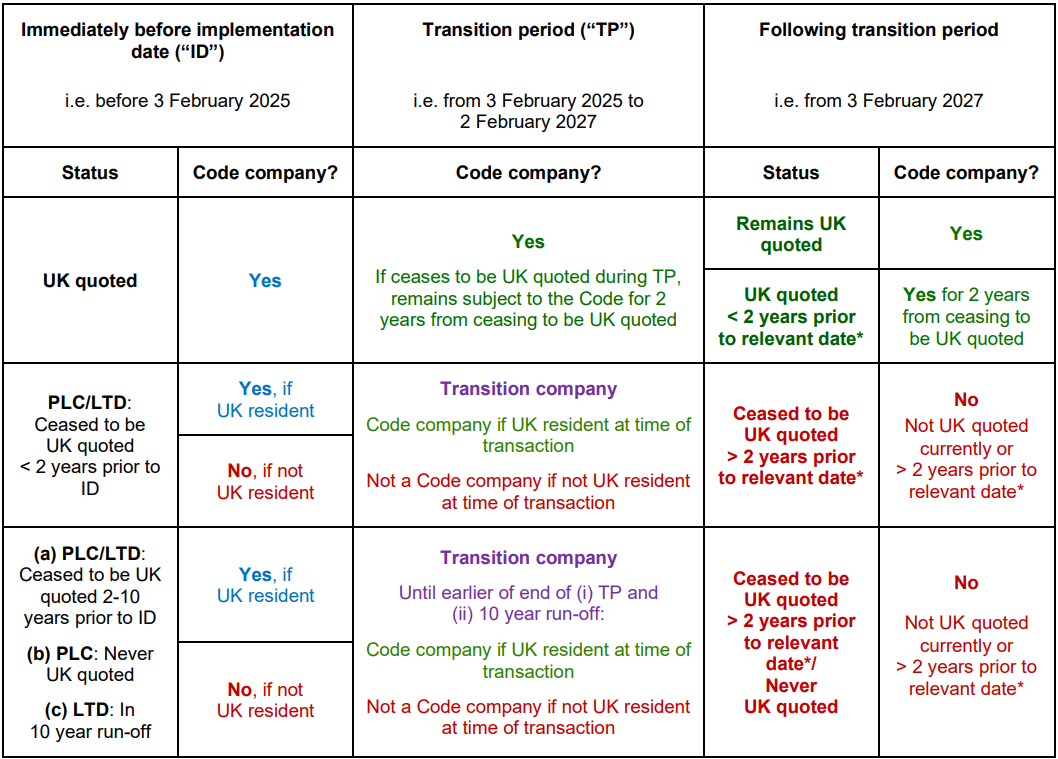

On 3 February 2025 (the “implementation date”), changes were made to the scope of the Panel’s jurisdiction. See below for a summary of the application of the Code before the implementation date, during the two year “transition period” and following the end of the transition period.

The changes to the scope of the Panel’s jurisdiction resulted from the consultation on PCP 2024/1 (Companies to which the Takeover Code applies), which was published by the Code Committee on 24 April 2024. The amendments to the Code were set out in RS 2024/1 and made by Instrument 2024/3, which were published on 6 November 2024.

Code companies

Following amendments made to the Code on 3 February 2025, the Code applies to any UK registered company if, on the relevant date*, either:

- any of its securities are admitted to trading on a UK regulated market, a UK multilateral trading facility or any stock exchange in the Channel Islands or the Isle of Man, i.e. if its securities are “UK quoted”; or

- its securities were UK quoted on or after 3 February 2025 and ceased to be UK quoted within the previous two years.

In addition, during the transition period from 3 February 2025 to 2 February 2027, the Code also applies to certain other public and private companies to which the Code applied on 2 February 2025, as explained below (referred to as “transition companies“). The transition period is intended to provide time for such transition companies, and their shareholders, to consider what action they may wish to take prior to the Code ceasing to apply to the company, which will occur by no later than 2 February 2027.

Transition companies

Until the Code was amended on 3 February 2025, the Code applied not only to UK registered companies which were UK quoted but also to:

- other UK registered public companies (see paragraph (ii) of former section 3(a) of the Introduction, as set out in the Transitional Appendix); and

- certain UK registered private companies (see paragraphs (ii)(A) to (D) of former section 3(a) of the Introduction),

which were considered by the Panel to have their place of central management and control in the UK, the Channel Islands or the Isle of Man (i.e. if the company was “UK resident”).

The private companies which fall within paragraphs (ii)(A) to (D) of former section 3(a) of the Introduction are:

- companies which were UK quoted at any time during the 10 years prior to the relevant date*;

- companies in respect of which dealings in securities, and/or prices at which persons were willing to deal in securities, were published on a regular basis for a continuous period of at least six months in the 10 years prior to the relevant date*;

- companies whose securities were subject to a marketing arrangement as described in section 693(3)(b) of the Companies Act 2006 at any time during the 10 years prior to the relevant date*; and

- companies which filed a prospectus at any time during the 10 years prior to the relevant date*.

These private companies are referred to as being in the “10 year run-off period”.

A company is a “transition company” if it is either:

- a company to which paragraph (ii) of former section 3(a) of the Introduction applied on 2 February 2025; or

- a company to which paragraph (ii) of former section 3(a) of the Introduction would have applied on 2 February 2025 if that company had been UK registered at that time.

During the transition period, the Code will apply to a transition company in the same way as it did immediately prior to the implementation date.

Whether or not the Code applies to a transition company in respect of a specific transaction will depend on the circumstances at the time of the relevant transaction, including:

- whether the company is UK resident at the time; and

- in the case of a private company that was in a 10 year run-off period on 2 February 2025, whether any of the 10 year run-off period remains outstanding.

The diagram here summarises whether a company was a transition company on the implementation date and the diagram here summarises whether the Code applies to a transition company on the relevant date*.

Companies to which the Code does not apply

The Code does not apply to a UK registered company which is not UK quoted (and which has not recently been UK quoted) solely by virtue of its securities or other interests being traded using another platform, such as:

- a Private Intermittent Securities and Capital Exchange System (or PISCES);

- a private market; or

- a secondary market of a crowdfunding platform.

Subject to the transitional arrangements described above, and provided that the company had not been UK quoted at any time during the two years prior to the relevant date*, the UK registered companies to which the Code does not apply include:

- a public or private company whose securities were UK quoted on or after 3 February 2025 but which ceased to be UK quoted more than two years prior to the relevant date*;

- a public or private company whose securities are, or were previously, admitted to trading solely on an overseas market;

- a public or private company whose securities are, or were previously, traded using a matched bargain facility;

- any other public company which is not UK quoted; and

- a private company which filed a prospectus at any time during the 10 years prior to the relevant date.

As indicated above, the Code does not apply to a company that is registered in any jurisdiction other than the UK, the Channel Islands or the Isle of Man.

*Relevant date is the date on which an announcement is made of an offer or possible offer for a company or on which some other event occurs in relation to the company which has significance under the Code.